Access the full document VAT challenges and opportunities in the new digital economy

It is with great pleasure for the Madrid VAT Forum Foundation to present the project on the challenges and opportunities posed by the digital economy in the field of VAT.

The phenomenon of the digital economy is undergoing a real revolution today. An enormous effort is being made by national administrations, as well as supranational bodies to ensure that this type of economy is taxed in the most reasonable and fair way possible.

The project has been developed by the Madrid VAT Forum Foundation with the participation of some renowned voices in the field of VAT in Europe.

Foundation activities

Publications and articles

Spanish version

Evidence of transport in intra-Community supplies after the FLO VENEER judgment (C-639/24)

The judgment of the CJEU of 13 November 2025, in case C-639/24, FLO VENEER, constitutes a decision of particular relevance in relation to the VAT exemption applicable to intra-Community supplies…

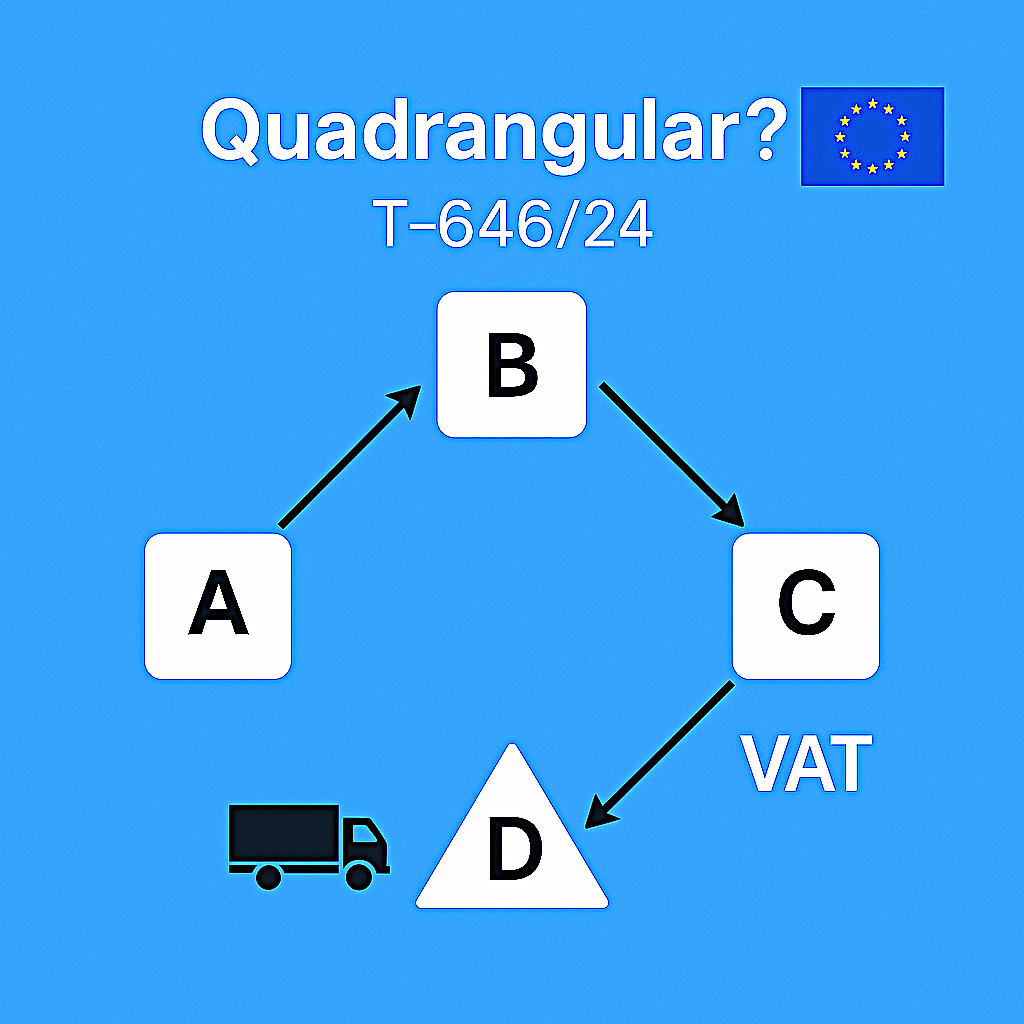

Leer másFrom triangular to “quadrangular” transactions. The General Court and complex Intra-EU supply chains

The judgment of the General Court in case T-646/24 addresses a classic issue of VAT on intra-Community transactions, namely the application of the triangular transactions regime in supply chains that…

Leer másThe stand-still clause tested: AG´s view on Spain’s VAT deduction restrictions (case C-515/24)

The recent case C-515/24, Randstad España, S.L.U. v. the Spanish State Administration, raises an unprecedented question in the field of VAT: can a Member State acceding to the EU introduce…

Leer másFrom matchmaker to supplier – Deemed supplies and the classification of platforms under EU VAT

Digitalization has placed platforms at the center of how services are priced and delivered, from ride-hailing and short-term accommodation to streaming, reservations and payments. The decisive issue for VAT is…

Leer másElectronic invoicing and real-time reporting in Spain: anticipating Europe’s VAT future under ViDA

The Spanish introduction of the invoicing scheme called VERIFACTU implies a regulatory framework that defines the requirements for invoicing software systems. Its primary goal is to fight fraud by preventing…

Leer más¿VERIFACTU? sí o sí, acabarás usando el SII

El Real Decreto 1007/2023, que introduce la figura de VERIFACTU, aprueba el Reglamento que establece los requisitos que deben adoptar los sistemas informáticos de facturación (SIF) cuyo objetivo principal es…

Leer másCJEU C-276/24: Joint liability complements deduction denial in combating VAT fraud

On 10 July 2025 the CJEU delivered its judgment in Case C-276/24. The ruling interprets Article 205 of the VAT Directive in light of the principle of proportionality and, more…

Leer másDigital platforms and VAT: AG reaffirms the role of Iitermediaries

On 10 April 2025, ECJ´s Advocate General (AG) issued his opinion in Case C-101/24, Finanzamt Hamburg-Altona v. XYRALITY GmbH. The case addresses the VAT treatment of services supplied electronically via…

Leer másPast events

- Date of the event: 8th February 2024.

- Place: Online event

- Topic of the conference: “2024-2028 The times of VAT in the Digital Age”

- Number of attendees: 193

- Link to the site of the event