Posts by Fernando Matesanz | Managing Director de Spanish VAT Services Asociados

Evidence of transport in intra-Community supplies after the FLO VENEER judgment (C-639/24)

The judgment of the CJEU of 13 November 2025, in case C-639/24, FLO VENEER, constitutes a decision of particular relevance in relation to the VAT exemption applicable to intra-Community supplies of goods. In particular, it clarifies the scope of Article 45a of the VAT Implementing Regulation and rejects excessively formalistic administrative interpretations that make the…

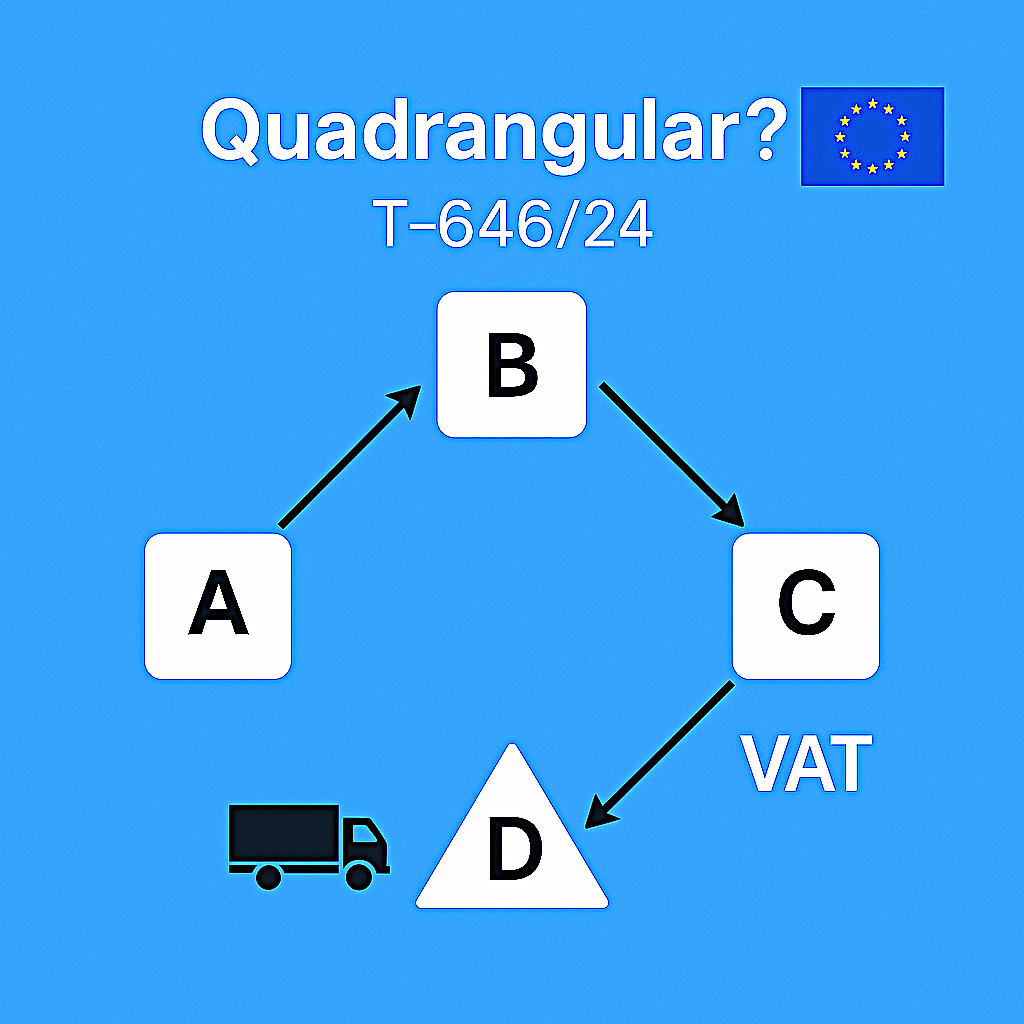

Read MoreFrom triangular to “quadrangular” transactions. The General Court and complex Intra-EU supply chains

The judgment of the General Court in case T-646/24 addresses a classic issue of VAT on intra-Community transactions, namely the application of the triangular transactions regime in supply chains that are more complex than the standard “ABC” scheme. In particular, the case concerns a chain involving four parties. In the case at hand, a company…

Read MoreThe stand-still clause tested: AG´s view on Spain’s VAT deduction restrictions (case C-515/24)

The recent case C-515/24, Randstad España, S.L.U. v. the Spanish State Administration, raises an unprecedented question in the field of VAT: can a Member State acceding to the EU introduce limitations on the right to deduct VAT at the very moment of its accession, relying on the stand-still clause laid down in Article 176, second…

Read MoreFrom matchmaker to supplier – Deemed supplies and the classification of platforms under EU VAT

Digitalization has placed platforms at the center of how services are priced and delivered, from ride-hailing and short-term accommodation to streaming, reservations and payments. The decisive issue for VAT is not only technological but also legal and economic. Does the platform act in the name and on behalf of the underlying supplier, or in its…

Read MoreElectronic invoicing and real-time reporting in Spain: anticipating Europe’s VAT future under ViDA

The Spanish introduction of the invoicing scheme called VERIFACTU implies a regulatory framework that defines the requirements for invoicing software systems. Its primary goal is to fight fraud by preventing the use of dual-use software and by ensuring that all interactions with invoicing systems are traceable and verifiable. Technically, these systems will have the ability—though…

Read MoreCJEU C-276/24: Joint liability complements deduction denial in combating VAT fraud

On 10 July 2025 the CJEU delivered its judgment in Case C-276/24. The ruling interprets Article 205 of the VAT Directive in light of the principle of proportionality and, more concretely, clarifies whether a Member State may both and at the same time (i) deny a purchaser the right to deduct input VAT because it…

Read MoreDigital platforms and VAT: AG reaffirms the role of Iitermediaries

On 10 April 2025, ECJ´s Advocate General (AG) issued his opinion in Case C-101/24, Finanzamt Hamburg-Altona v. XYRALITY GmbH. The case addresses the VAT treatment of services supplied electronically via a digital marketplace, focusing on the application of Article 28 of the VAT Directive and the determination of the place of supply under Articles 44…

Read MorePlatform economy: challenges and tax Implications under DAC 7 and VAT

The digital economy, particularly through the phenomenon of the “servitization” and the “platform economy,” has significantly transformed the interactions between businesses, consumers, and tax administrations. This shift represents an evolution from a traditional ownership-based model to one centered on access to services. In this new landscape, consumers benefit from improved accessibility and usage conditions for…

Read MoreCan formalism undermine the principle of VAT neutrality? Spanish courts take a step in the right direction

One of the cornerstones of the EU common VAT system is its neutrality. This principle ensures that the tax ultimately burdens the final consumer and should never become a cost for businesses or professionals who act merely as tax collectors. The VAT taxable person is, ultimately, a collaborator of the Tax Administration in the collection…

Read MoreSame products, different VAT rates

Just a few days ago, the Court of Justice of the EU (CJEU) issued a judgment (Case C-146/22, YD) on the power of Member States to apply reduced VAT rates to certain supplies of goods and services.

Read More